Sending and receiving money has never been easier than in 2025. With instant money transfer apps, users can transfer funds to friends, family, or businesses within seconds. Whether it’s splitting a dinner bill, paying rent, or sending money internationally, these apps make transactions fast, secure, and convenient. This guide explores the best apps for instant money transfers, their features, benefits, drawbacks, and tips for safe and efficient usage.

Why Instant Money Transfer Apps Matter

Traditional bank transfers can take days, especially for cross-bank or international transactions. Instant money transfer apps provide:

- Speed: Transfers complete in seconds, not days.

- Convenience: Mobile-first platforms allow sending money anytime, anywhere.

- Accessibility: Send money using phone numbers, emails, or app IDs.

- Cost Savings: Many apps charge little to no fees compared to bank wire transfers.

- Integration: Apps often link directly to bank accounts, debit/credit cards, and even digital wallets.

SEO keyword: instant money transfer apps 2025

How Instant Money Transfer Apps Work

Most apps operate on a few core principles:

- Link Your Accounts: Connect your bank account, debit card, or credit card to the app.

- Identify Recipient: Send money using email, phone number, or app username.

- Confirm Transfer: Enter amount, select account, and confirm. The recipient usually receives funds instantly.

- Notifications: Both sender and recipient receive instant notifications.

Security features like encryption and two-factor authentication ensure transfers are safe.

Top Instant Money Transfer Apps in 2025

Here’s a list of the best instant money transfer apps for 2025:

1. Venmo

Venmo is widely popular in the U.S. for peer-to-peer payments.

Features:

- Instant transfers to friends or businesses

- Social feed to track payments

- Bank account, debit, or credit card linkage

Benefits:

- Easy to use

- Free standard transfers to bank accounts

- Social features enhance convenience for groups

Drawbacks:

- Fees for instant bank transfers (~1–3%)

- Privacy concerns with social feed

SEO keyword: Venmo instant transfers 2025

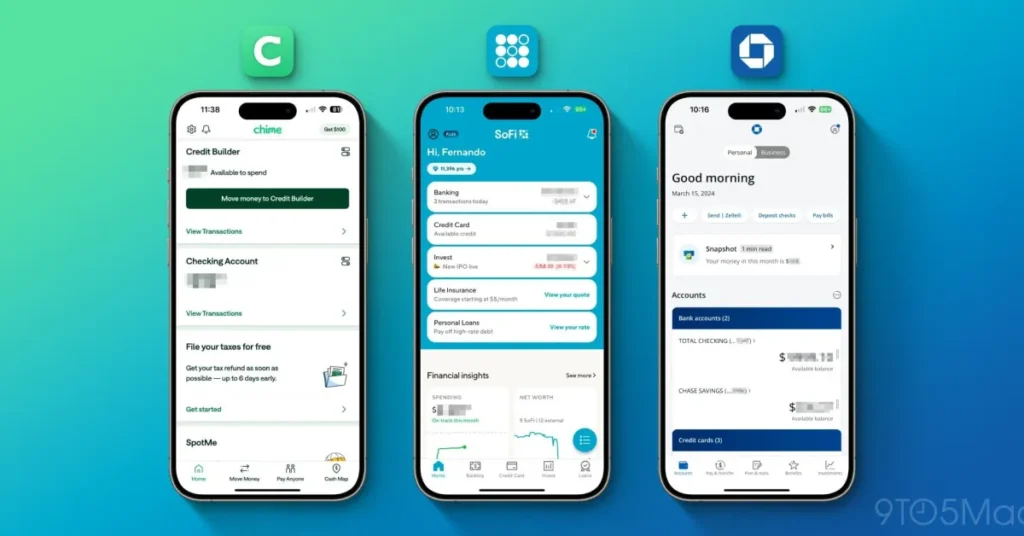

2. Zelle

Zelle is integrated with many U.S. banks for fast, secure transfers.

Features:

- Direct bank-to-bank transfers

- Instant delivery for most transactions

- No fees

Benefits:

- Secure and widely adopted

- No need for a separate app if bank supports Zelle

- Works with almost all major U.S. banks

Drawbacks:

- Limited international transfers

- Transactions are instant—mistakes cannot easily be reversed

SEO keyword: Zelle money transfer 2025

3. PayPal

PayPal is a global platform suitable for both peer-to-peer and international transfers.

Features:

- Instant domestic and international transfers

- Supports multiple currencies

- Linked to bank accounts, debit, or credit cards

Benefits:

- Global coverage

- Buyer and seller protection

- Convenient for online purchases and money transfers

Drawbacks:

- Fees for instant transfers and currency conversion

- Account freezes can occur for security reasons

SEO keyword: PayPal instant money transfer 2025

4. Cash App

Cash App combines peer-to-peer payments with investing features.

Features:

- Instant transfers to friends or businesses

- Bitcoin and stock investing

- Cash Card for spending balance

Benefits:

- Simple, mobile-first interface

- Integrated investing platform

- Supports instant transfers

Drawbacks:

- Limited customer support

- Fees for instant transfers (1.5–3%)

SEO keyword: Cash App instant transfer 2025

5. Wise (Formerly TransferWise)

Wise specializes in international money transfers with low fees.

Features:

- Fast global transfers

- Real exchange rate with low fees

- Multi-currency accounts

Benefits:

- Ideal for sending money abroad

- Transparent fee structure

- Multi-currency support for frequent travelers

Drawbacks:

- Not instant in all countries

- Requires app setup and verification

SEO keyword: Wise money transfer 2025

6. Remitly

Remitly focuses on cross-border remittances with instant delivery options.

Features:

- Express transfers for immediate delivery

- Competitive rates

- Partnered with global banks and cash pickup points

Benefits:

- Fast international transfers

- Low fees for select corridors

- Mobile app simplifies the process

Drawbacks:

- Fees may apply for instant transfers

- Limited coverage in some countries

SEO keyword: Remitly instant money 2025

7. Google Pay

Google Pay integrates payments and banking features in a single app.

Features:

- Peer-to-peer instant transfers

- Bank account and card linking

- NFC payments for in-store purchases

Benefits:

- Easy integration with Android devices

- Instant notifications for transactions

- No fees for domestic transfers

Drawbacks:

- Limited global coverage for instant transfers

- iOS users face reduced functionality

SEO keyword: Google Pay instant transfer 2025

8. Apple Pay

Apple Pay offers secure, instant transfers for iOS users.

Features:

- Send money via Messages

- Secure NFC payments

- Linked to Apple Cash and bank accounts

Benefits:

- Native iOS integration

- Instant transfers between Apple devices

- High security with Face ID/Touch ID

Drawbacks:

- Only available on Apple devices

- Limited international transfers

SEO keyword: Apple Pay money transfer 2025

How to Safely Use Instant Money Transfer Apps

- Enable Two-Factor Authentication – Protects your account from unauthorized access.

- Verify Recipient Details – Double-check phone numbers, email addresses, or account IDs.

- Avoid Public Wi-Fi – Use secure networks for financial transactions.

- Set Transfer Limits – Minimize loss in case of fraud.

- Monitor Transactions – Regularly check app notifications and bank statements.

SEO keyword: safe money transfer apps 2025

Tips for Choosing the Right App

- Purpose: Use Zelle or Cash App for domestic P2P payments; Wise or Remitly for international transfers.

- Fees: Compare transfer fees and currency conversion costs.

- Speed: Choose instant transfers if timing is critical.

- Security: Prioritize apps with encryption, fraud detection, and customer support.

- Integration: Apps that link to your bank account or budgeting tools enhance convenience.

SEO keyword: best money transfer apps 2025

Benefits of Using Instant Money Transfer Apps

- Convenience: Send money anytime without visiting a bank.

- Speed: Receive funds within seconds or minutes.

- Cost-Effective: Many apps have low or no fees.

- Global Reach: Some apps support international transfers.

- Integration with Financial Tools: Helps manage budgeting and expenses in real-time.

Common Mistakes to Avoid

- Sending to the Wrong Recipient – Always double-check details.

- Ignoring Fees – Some apps charge for instant transfers.

- Over-Reliance on Mobile Networks – Poor connectivity can delay transfers.

- Neglecting Security Features – Skip features like two-factor authentication at your own risk.

- Not Updating the App – Always use the latest version for security and functionality.

Conclusion

Instant money transfer apps in 2025 make sending and receiving funds fast, secure, and convenient. Apps like Venmo, Zelle, PayPal, Cash App, Wise, Remitly, Google Pay, and Apple Pay cover a range of needs—from domestic peer-to-peer payments to international money transfers.

By selecting the right app, enabling security features, and monitoring transactions, you can save time, avoid unnecessary fees, and improve your financial management. Whether for personal use, business transactions, or international remittances, instant money transfer apps are essential tools for modern financial life.