Saving money consistently can be challenging, especially with rising expenses and fast-paced lifestyles. Luckily, technology has made saving effortless. In 2025, a variety of apps allow you to automatically save money, set goals, and even invest spare change, all without thinking twice. This guide explores the best apps to automate your savings, how they work, their benefits, drawbacks, and tips to maximize your savings.

Why Automating Your Savings Is Essential

Automated savings help you build wealth without constant effort. Here’s why it’s a game-changer:

- Consistency: Regular, automatic transfers ensure you save every month.

- Reduces Temptation: Money moves into savings before you can spend it.

- Goal-Oriented: Apps allow you to save for vacations, emergencies, or investments.

- Interest Growth: Money grows faster when consistently saved in high-yield accounts.

- Behavioral Advantage: Automation uses psychology to create better financial habits.

SEO keyword: automate savings 2025, best saving apps

How Savings Apps Work

Most savings apps use simple mechanisms to help you save effortlessly:

1. Round-Ups

- Apps like Acorns round up each purchase to the nearest dollar and invest or save the difference.

- Example: Buy coffee for $3.50 → $0.50 goes into savings automatically.

2. Scheduled Transfers

- Set daily, weekly, or monthly transfers from checking to savings accounts.

- Ensures consistent contribution to your financial goals.

3. Goal-Based Saving

- Define specific goals (e.g., vacation, emergency fund).

- Apps track progress and notify you when milestones are reached.

4. AI-Powered Suggestions

- Some apps analyze spending patterns to suggest small amounts to save.

- Helps increase savings without affecting lifestyle drastically.

Top Apps to Automate Your Savings in 2025

Here’s a curated list of the best savings apps to maximize your financial growth:

1. Acorns

Acorns is a popular app for round-up savings and micro-investing.

Features:

- Rounds up purchases to the nearest dollar.

- Invests spare change in diversified portfolios.

- Offers retirement accounts and recurring deposits.

Benefits:

- Automates both saving and investing.

- Encourages long-term wealth building.

- Beginner-friendly interface.

Drawbacks:

- Monthly fee ($3–$5)

- Small balances grow slowly without additional contributions

SEO keyword: Acorns savings app 2025

2. Qapital

Qapital uses rule-based automation to help users save in creative ways.

Features:

- Round-ups, set-and-forget goals, and “Spend Less” rules.

- Can link to debit or credit cards for automatic transfers.

- Goal-oriented features for vacations, bills, or debt payoff.

Benefits:

- Customizable savings rules.

- Encourages behavior-based savings.

- Integrates with other financial accounts.

Drawbacks:

- Monthly subscription (~$3–$12)

- Limited investment options

SEO keyword: Qapital automated savings 2025

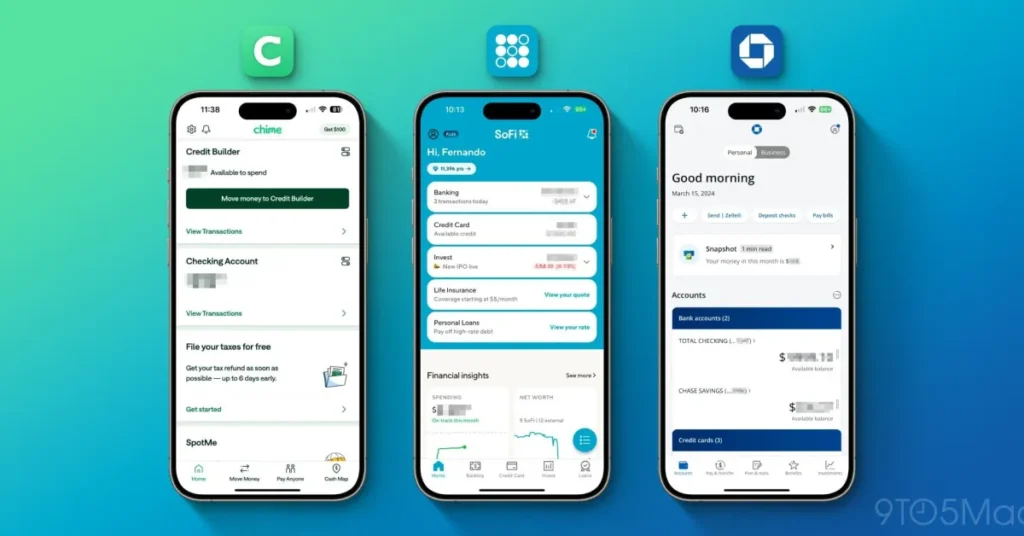

3. Chime

Chime is a mobile bank that helps automate savings without complex setup.

Features:

- Automatic round-ups

- Save When You Get Paid feature (percentage of paycheck moves to savings)

- High-yield savings account

Benefits:

- Fee-free banking

- Easy for beginners

- High APY for savings

Drawbacks:

- Limited advanced budgeting features

- No physical branches

SEO keyword: Chime savings automation 2025

4. Digit

Digit is an AI-driven app that automatically calculates how much you can save based on income and spending habits.

Features:

- Automatically transfers small amounts to a Digit account

- Tracks spending to avoid overdrafts

- Offers goal-specific saving and emergency funds

Benefits:

- Requires minimal user input

- Personalized savings approach

- Helps build emergency funds automatically

Drawbacks:

- Monthly fee (~$5)

- Works best with stable income

SEO keyword: Digit app 2025

5. Simple (now part of BBVA/PNC)

Simple offers goal-based automated savings for its account holders.

Features:

- Safe-to-Spend feature calculates how much is available to spend vs save

- Round-ups and scheduled transfers

- Goal-specific accounts for emergency or special purposes

Benefits:

- Combines checking and savings automation

- Intuitive mobile interface

- Encourages mindful spending

Drawbacks:

- Limited to U.S. residents

- Account closure and transition to PNC may affect users

SEO keyword: Simple bank savings app 2025

6. Twine

Twine is ideal for shared savings goals, especially couples or roommates.

Features:

- Create joint savings goals

- Automatic contributions

- Track progress and split savings responsibilities

Benefits:

- Encourages collaborative saving

- Visual progress tracking motivates consistent contributions

- Helps achieve shared financial goals faster

Drawbacks:

- Not ideal for individual savers

- Limited investment options

SEO keyword: Twine savings app 2025

7. YNAB (You Need a Budget)

While primarily a budgeting tool, YNAB supports automated transfers to savings goals.

Features:

- Link accounts for real-time transaction tracking

- Assign funds to goals

- Reports to track progress over time

Benefits:

- Combines budgeting with saving

- Encourages disciplined financial habits

- Suitable for long-term planning

Drawbacks:

- Paid subscription (~$14.99/month)

- Learning curve for beginners

SEO keyword: YNAB automated savings 2025

8. Marcus by Goldman Sachs

Marcus offers a high-yield savings account with automation options.

Features:

- Recurring transfers from checking

- High APY for consistent savings

- No fees or minimum balances

Benefits:

- Safe, FDIC-insured account

- Encourages long-term wealth building

- Simple setup for beginners

Drawbacks:

- No round-up features

- Mobile app less interactive than others

SEO keyword: Marcus automated savings 2025

Tips to Maximize Automated Savings

- Start Small – Even $5–$10 per day adds up quickly.

- Set Clear Goals – Use app features to define specific targets.

- Round-Up Wisely – Combine round-ups with scheduled transfers for faster growth.

- Monitor Progress – Regularly check app insights to stay motivated.

- Adjust Based on Spending – Increase savings if income rises or expenses drop.

SEO keyword: maximize savings apps 2025

Benefits of Automating Savings

- Effortless Growth: Money grows without manual intervention.

- Behavioral Advantage: Reduces impulse spending.

- Goal Achievement: Easier to save for vacations, emergencies, or investments.

- Financial Security: Build emergency funds without stress.

- Compound Interest: Consistent savings in high-yield accounts grow faster over time.

Common Mistakes to Avoid

- Neglecting to Monitor Accounts – Ensure automated savings do not overdraft your checking.

- Ignoring Fees – Some apps charge subscriptions that eat into small savings.

- Overestimating Capacity – Start with manageable amounts to avoid stress.

- Not Setting Goals – Without goals, motivation to continue may drop.

- Failing to Adjust – Reassess savings rates as income and expenses change.

Conclusion

Automating your savings in 2025 is one of the smartest financial moves you can make. With apps like Acorns, Qapital, Chime, Digit, and Twine, you can save consistently, reach goals faster, and build long-term wealth without thinking twice. By combining automation, goal-setting, and smart financial planning, anyone can turn saving from a chore into a seamless habit.

Start using an automated savings app today to take control of your finances, reduce stress, and grow your wealth effortlessly.