Banking has evolved rapidly in recent years. By 2025, many customers are faced with a choice: should they continue using traditional banks or switch entirely to mobile banking apps? Both options offer unique advantages and disadvantages, and understanding them is crucial to managing your money efficiently. This guide explores the pros and cons of mobile banking and traditional banking, helping you make informed decisions based on your lifestyle, financial goals, and personal preferences.

Understanding Mobile Banking in 2025

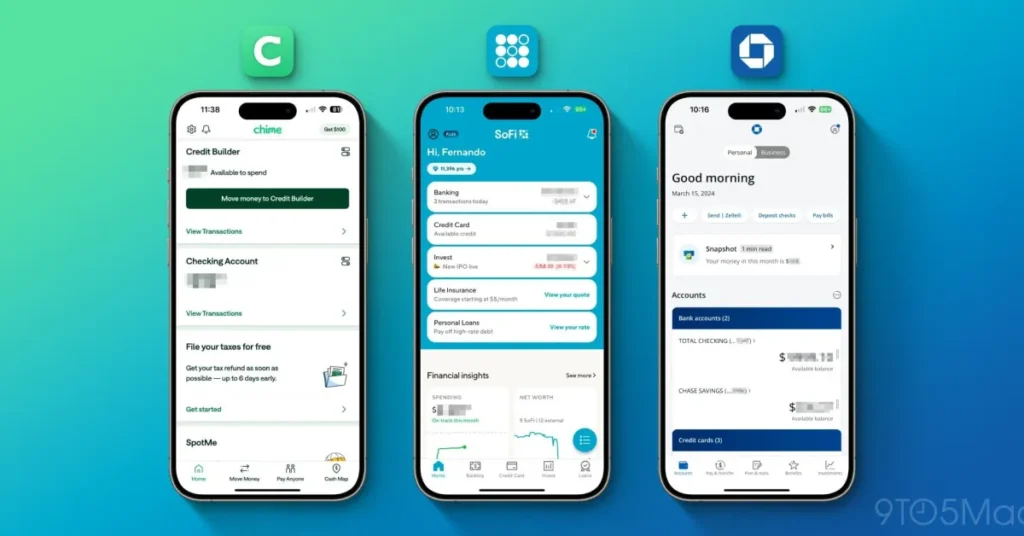

Mobile banking allows you to manage your finances directly from your smartphone or tablet. Modern mobile banking apps offer features far beyond simple account balances and transfers.

Key Features of Mobile Banking

- Account Management: View balances, transaction history, and statements.

- Bill Payment: Pay utility bills, rent, and subscriptions instantly.

- Transfers: Send money to friends, family, or other accounts in real-time.

- Mobile Deposits: Deposit checks by photographing them with your phone.

- Budgeting Tools: Categorize expenses and monitor spending trends.

- Alerts & Notifications: Receive instant notifications for transactions, low balances, or suspicious activity.

SEO keyword: mobile banking 2025

Understanding Traditional Banking

Traditional banks are the brick-and-mortar financial institutions that have existed for decades. They offer in-person services and physical branches for customers.

Key Features of Traditional Banking

- Branch Access: In-person support for deposits, withdrawals, and financial advice.

- ATM Networks: Widely available for cash access.

- Full-Service Options: Mortgages, loans, investment advice, and wealth management.

- Safety & Security: Physical oversight combined with regulated federal protections.

SEO keyword: traditional banking pros and cons 2025

Pros of Mobile Banking

Mobile banking offers convenience and technology-driven features that traditional banks cannot always match.

1. Convenience

- Access your accounts anytime, anywhere.

- Complete transactions without visiting a branch.

- Manage multiple accounts and cards from a single app.

2. Speed

- Instant money transfers between accounts or to other people.

- Mobile deposits eliminate waiting in lines or mailing checks.

3. Budgeting & Tracking

- Automatically categorize spending for budgeting purposes.

- Real-time alerts help prevent overdrafts and overspending.

4. Lower Fees

- Many mobile-first banks offer fee-free accounts with no monthly maintenance or minimum balances.

5. Integration with Financial Tools

- Seamless connection to apps for investments, savings, and bill tracking.

- AI-driven insights to optimize spending and savings.

SEO keyword: benefits of mobile banking 2025

Cons of Mobile Banking

Despite its advantages, mobile banking has some limitations:

1. Limited Physical Access

- No in-person support for complex transactions or issues.

- Cash deposits may be difficult without linked ATMs.

2. Technology Dependence

- Requires a smartphone, stable internet, and tech literacy.

- App outages or glitches can temporarily block access.

3. Security Risks

- Mobile banking apps can be targeted by hackers.

- Users must enable two-factor authentication and secure devices.

4. Fewer Full-Service Options

- Some mobile banks do not offer loans, mortgages, or in-depth financial advice.

SEO keyword: mobile banking disadvantages 2025

Pros of Traditional Banking

Traditional banks have stood the test of time, providing personalized services and trusted financial infrastructure.

1. In-Person Support

- Access to tellers and bankers for guidance or problem resolution.

- Personalized financial advice for loans, mortgages, and investments.

2. Cash Handling

- Easy cash deposits, withdrawals, and check handling.

- Access to larger ATM networks and physical branches.

3. Reputation & Trust

- Regulated institutions with federal insurance (FDIC in the U.S.).

- Established credibility and security systems.

4. Comprehensive Services

- Loans, mortgages, business accounts, wealth management, and investment services.

SEO keyword: traditional banking advantages 2025

Cons of Traditional Banking

While traditional banks offer many benefits, they also have drawbacks:

1. Inconvenience

- Need to visit branches during business hours.

- Longer processing times for transfers and deposits.

2. Higher Fees

- Monthly maintenance fees, ATM fees, and minimum balance requirements.

- Overdraft fees can accumulate quickly.

3. Limited Technology Features

- Many traditional banks lag in app usability and digital tools.

- Budget tracking and real-time alerts may be minimal.

4. Slower Transactions

- Transfers and check processing take longer compared to mobile-first banks.

SEO keyword: traditional banking disadvantages 2025

Key Differences Between Mobile and Traditional Banking

| Feature | Mobile Banking | Traditional Banking |

|---|---|---|

| Accessibility | 24/7 from anywhere | Limited to branch hours |

| Fees | Usually low or none | Often higher |

| Speed | Instant transfers & deposits | Slower processing |

| Customer Support | Digital support | In-person and phone support |

| Services | Limited loans & investments | Full-service options |

| Budgeting Tools | Integrated and AI-driven | Minimal or manual |

| Cash Handling | Limited | Easy access to cash and checks |

How to Choose the Right Option for You

When deciding between mobile and traditional banking, consider the following:

- Lifestyle Needs

- If you are always on-the-go, mobile banking may suit you better.

- If you need in-person services or access to cash, traditional banking may be preferable.

- Financial Goals

- Mobile banking helps with budgeting, tracking, and automated savings.

- Traditional banks provide robust services for mortgages, investments, and business needs.

- Technology Comfort

- Comfortable with apps, smartphones, and online security? Mobile banking is ideal.

- Prefer face-to-face interactions? Traditional banks remain reliable.

- Fee Sensitivity

- Mobile banks often offer free accounts with low or zero fees.

- Traditional banks may charge for maintenance, overdrafts, or minimum balances.

SEO keyword: mobile vs traditional banking 2025

Hybrid Approach: Combining Both

Many users in 2025 opt for a hybrid approach, leveraging both mobile and traditional banking:

- Primary Checking Account: Use a mobile bank for daily transactions and budgeting.

- Specialized Accounts: Maintain a traditional bank account for mortgages, loans, or business accounts.

- Investment Integration: Connect mobile apps to traditional bank accounts for a holistic financial view.

Benefits of a hybrid approach:

- Access to fast digital services and full-service banking.

- Flexibility and safety through diversification.

- Optimal combination of convenience, security, and comprehensive services.

Tips for Maximizing Mobile and Traditional Banking

- Monitor Accounts Regularly – Use apps to track spending and reconcile with traditional bank statements.

- Enable Security Features – Two-factor authentication, strong passwords, and alerts protect accounts.

- Automate Transactions – Pay bills and transfer money automatically to avoid late fees.

- Leverage Technology – Use budgeting and savings tools offered by mobile apps.

- Maintain Good Relationships – Keep communication with traditional bank advisors for personalized advice.

SEO keyword: banking tips 2025

Conclusion

In 2025, the choice between mobile banking and traditional banking is not mutually exclusive. Both have unique strengths and weaknesses, and the right choice depends on your financial needs, lifestyle, and comfort with technology.

- Mobile Banking: Offers speed, convenience, and budgeting tools.

- Traditional Banking: Provides in-person support, comprehensive services, and secure cash handling.

- Hybrid Approach: Combines the best of both worlds for maximum efficiency and security.

By understanding the pros and cons of each, you can make informed decisions, maximize your financial management, and achieve long-term financial goals in the digital era.