Investing often feels like something only the rich can afford. We imagine Wall Street traders or people with thousands of dollars buying stocks every day. But the truth is, you can start investing with as little as $100.

In today’s digital age, technology and financial innovation have opened doors for everyone—students, employees, and young entrepreneurs—to build wealth with small, consistent steps. This article will show you how to invest your first $100 wisely, what tools to use, and how to turn it into the foundation of long-term financial success.

1. The Mindset of a Smart Investor

Before talking about platforms or stocks, let’s start with something more important—your mindset.

The difference between people who grow wealth and those who don’t isn’t always income; it’s how they manage and think about money.

Smart investors focus on:

- Consistency over quantity — Small, regular investments matter more than one-time big moves.

- Long-term goals — You’re not gambling; you’re building wealth.

- Learning — Understanding your investments reduces risk.

Even if you only invest $100 today, the mindset you develop is priceless.

2. Why Start Small? The Power of Compounding

When you invest, your money earns a return—and that return can earn its own return. This is the magic of compound interest.

Example:

If you invest $100 and earn 8% per year, after:

- 1 year → $108

- 5 years → $147

- 10 years → $216

- 20 years → $466

Now imagine adding just $50 every month—you could have thousands in a few years.

Starting small isn’t a weakness—it’s a strategy. It builds the habit of investing without fear of losing large sums.

3. Choose Your Investment Goal

Ask yourself: What do I want this money to do?

Your goal determines your investment type. Here are common ones:

- Short-term goals (1–3 years) → safer, low-risk options like savings accounts or CDs.

- Mid-term goals (3–7 years) → index funds or ETFs for steady growth.

- Long-term goals (7+ years) → stocks, retirement accounts, crypto (for risk-tolerant investors).

💡 Tip: Write your goal down—it gives direction and motivation to stay consistent.

4. The Best Ways to Invest $100

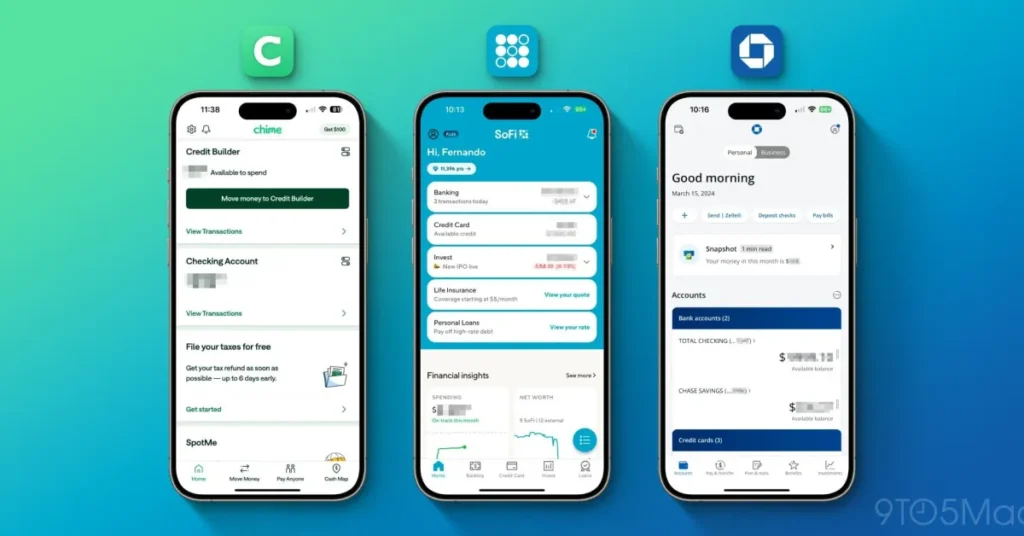

a) Micro-Investing Apps

Platforms like Acorns, Robinhood, or Public allow you to start with $5–$10.

They round up your purchases and invest the change into ETFs or stocks automatically.

Benefits:

- No minimum balance.

- User-friendly.

- Educational tools built-in.

Drawback:

Small fees can eat into tiny balances, so monitor costs.

b) Exchange-Traded Funds (ETFs)

ETFs are bundles of many stocks or bonds—great for beginners.

For example, the S&P 500 ETF (VOO) lets you own a piece of 500 top U.S. companies.

With fractional shares, you can buy even $10 worth of a $400 stock.

This gives instant diversification and lower risk than buying a single company.

c) High-Yield Savings or Certificates of Deposit (CDs)

If you’re not ready for market risk, place your $100 in a high-yield savings account.

Many online banks offer 4–5% annual interest with full safety (FDIC insured).

You won’t get rich, but your money grows faster than in a regular bank account—perfect for beginners.

d) Invest in Yourself

Sometimes, the best investment is education.

Spend your $100 on:

- A finance course

- A book on investing

- An online workshop or podcast subscription

This investment in knowledge compounds for life.

5. Understanding Bank Fees Before You Invest

Before you start investing, check your banking costs.

Many people lose money unknowingly through:

- Monthly account fees

- ATM withdrawal charges

- Transfer or overdraft fees

Switch to online banks or digital accounts with zero fees and better interest rates.

The less you pay in fees, the more you can invest.

💡 Smart move: Always read the fine print—banks and brokers make billions from hidden charges.

6. Inflation: The Silent Wealth Killer

If you keep your $100 under your mattress, inflation will quietly make it worth less every year.

Inflation means prices rise over time. A $100 grocery bill today might cost $120 in a few years.

So, saving money isn’t enough—you must invest it so it grows faster than inflation.

That’s why investing is not optional—it’s financial protection.

7. Step-by-Step Plan: How to Invest Your First $100

Step 1: Open a brokerage or investing app (e.g., Fidelity, Robinhood, Public, eToro).

Step 2: Deposit your $100.

Step 3: Choose 1–2 low-cost ETFs or index funds.

Step 4: Turn on auto-invest monthly.

Step 5: Track your progress once a month—don’t panic over daily changes.

Step 6: Reinvest any earnings or dividends.

This habit is more powerful than market timing—it’s the secret to building wealth.

8. Diversify and Manage Risk

Even with $100, you can diversify by owning fractional shares of ETFs or companies.

Avoid putting all your money in one stock or one type of investment.

Balance your portfolio with:

- Equities (stocks) for growth

- Bonds or ETFs for stability

- Cash or savings for emergencies

As your investments grow, rebalance yearly—just like tuning an instrument.

9. Learn, Adapt, and Stay Consistent

Investing is a journey, not a sprint.

Markets rise and fall—but knowledge and discipline create success.

Read books like The Little Book of Common Sense Investing by John C. Bogle or Rich Dad Poor Dad by Robert Kiyosaki.

Follow credible financial news—not hype or fear-based content.

Remember: You don’t need to be rich to start, but you must start to become rich.

10. The Bigger Picture: Finance, Banking, and the Economy

Every dollar you invest connects you to the global economy.

When you buy ETFs or stocks, you’re funding innovation, companies, and job creation.

When you save in banks, they use your deposits to lend and support economic activity.

Your money is not just sitting—it’s circulating, growing the economy while building your personal wealth.

That’s why financial literacy and small investments have a big impact on both personal and national prosperity.

Conclusion: Start Small, Think Big

Starting with $100 might not seem like much—but it’s the first brick of your financial foundation.

By understanding bank fees, protecting yourself from inflation, and investing consistently, you take control of your financial future.

Wealth doesn’t come from luck—it comes from knowledge, patience, and action.

So today, take your $100 and make it your first step toward financial freedom.

Your future self will thank you.

🧭 Key Takeaways

- You can start investing with as little as $100.

- Choose beginner-friendly platforms or ETFs.

- Avoid high bank fees—they eat your returns.

- Beat inflation by making your money work for you.

- Consistency + education = wealth over time.